🗣 SL提问: Zero-couponbond

✍️ Ai批改: A zero-coupon bond!

A zero-coupon bond, also known as a zero or a discount bond, is a type of bond that does not pay periodic interest (coupons) to the investor、Instead, it is sold at a discount to its face value and pays out the face value at maturity.

Here's a brief overview:

Key characteristics:

1、No interest payments: Unlike traditional bonds, zero-coupon bonds do not make periodic interest payments to the investor.

2、Sold at discount: The bond is sold at a price lower than its face value, which is the amount the bond will pay out at maturity.

3、Face value at maturity: The bond pays out its face value (also known as the par value or principal) at maturity.

How it works:

1、An investor buys a zero-coupon bond at a discounted price, say $80.

2、The bond has a face value of $100 and a maturity date, say 5 years from now.

3、The investor does not receive any interest payments over the 5-year period.

4、At maturity, the bond issuer pays out the face value of $100 to the investor.

Example:

Suppose you buy a 5-year zero-coupon bond with a face value of $1,000 for $800、At maturity, you will receive $1,000.

Benefits and risks:

Benefits:

* Low purchase price: Zero-coupon bonds can be attractive to investors who want to buy a bond at a discount.

* Predictable return: The investor knows exactly how much they will receive at maturity.

Risks:

* No regular income: The investor does not receive any regular interest payments.

* Interest rate risk: Changes in interest rates can affect the bond's market value.

Who issues zero-coupon bonds:

Governments, corporations, and financial institutions issue zero-coupon bonds、In the United States, the Treasury Department issues Treasury bills (T-bills) and Treasury STRIPS (Separate Trading of Registered Interest and Principal Securities), which are types of zero-coupon bonds.

Tax implications:

The IRS requires investors to report the imputed interest on their tax returns each year, even though they do not receive any interest payments until maturity.

Investor suitability:

Zero-coupon bonds can be suitable for:

1、Long-term investors who want to lock in a fixed return.

2、Investors who want to fund a specific future expense, such as a child's education.

3、Investors who are willing to hold the bond until maturity.

Keep in mind that zero-coupon bonds can be volatile in the secondary market, and their value may fluctuate with changes in interest rates、It's essential to evaluate your investment goals and risk tolerance before investing in zero-coupon bonds.

0

IP地址: 181.230.99.62

搜索次数: 56

提问时间: 2025-04-11 11:34:10

❓️ 热门提问:

2018年至2020年黄金价格走势图

泰福泵业

黄金买什么牌子比较实惠

黄金吊坠的项链

沪金期货手续费

黄金首饰多少钱一克

看图写诗ai

ai的产业链

八字命中带金

粉金首饰

豌豆Ai站群搜索引擎系统

🤝 关于我们:

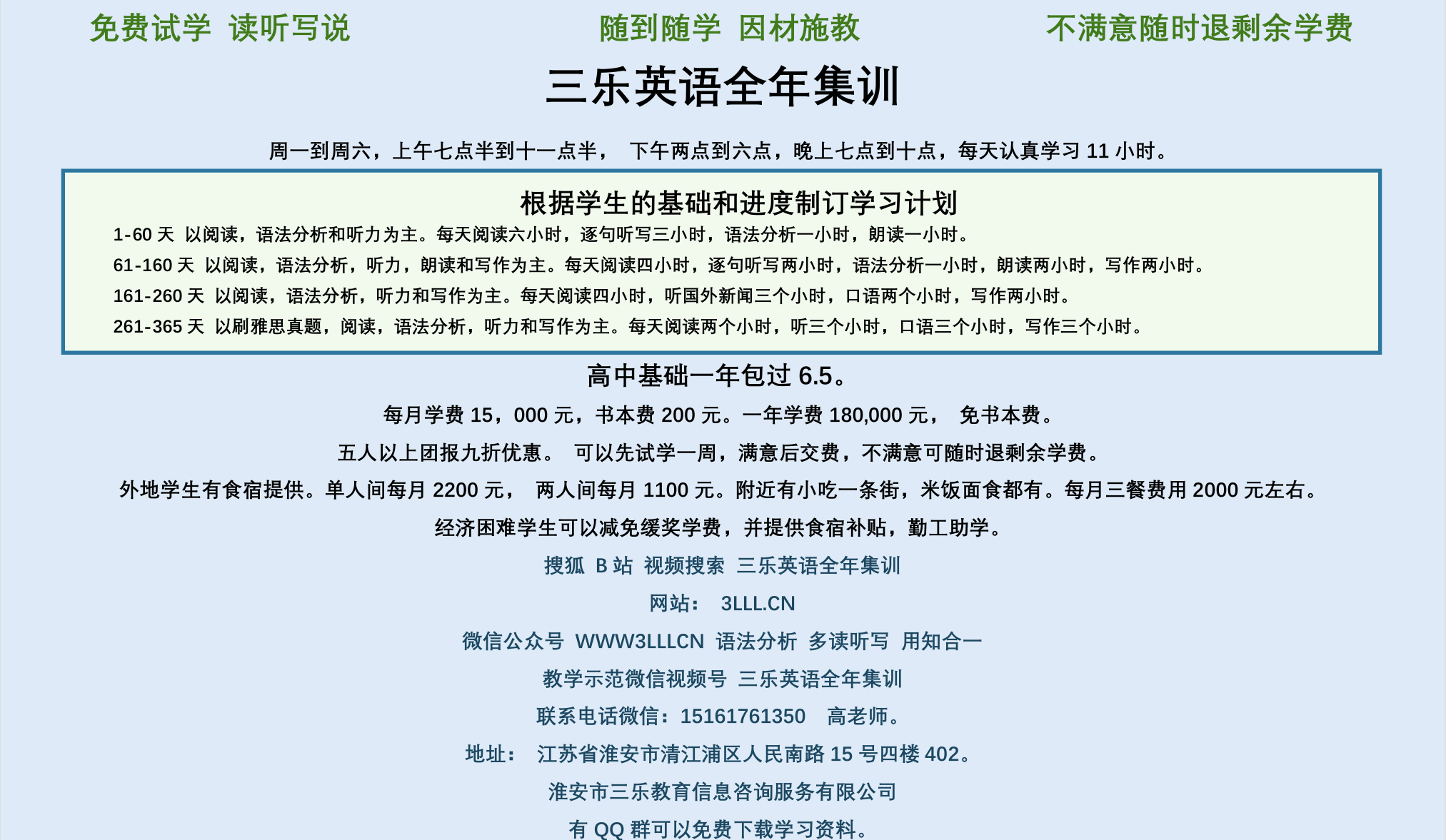

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

英语培训

本站流量

联系我们

📢 温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

👉 技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。